Fixed Indexed Annuities

for a safer retirement:

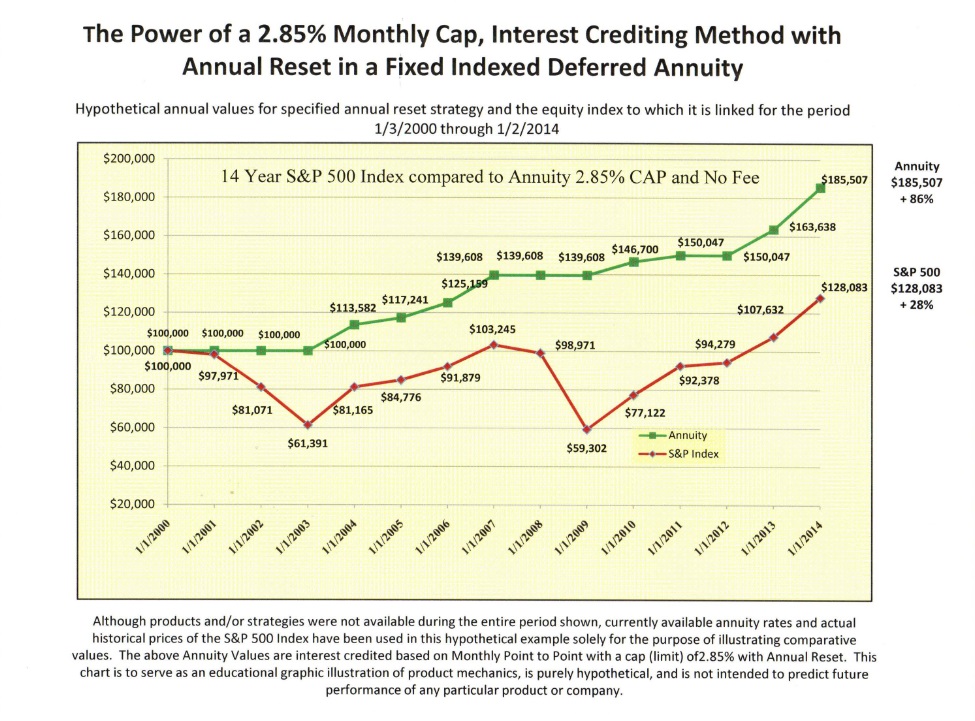

Fixed Indexed Annuities [FIAs] are issued by Legal Reserve Life Insurance Companies and are considered one of the safest long-term investments, after US Treasuries. FIAs are tied to [not invested in] a stock market index (i.e. NASDAQ, NYSE, S&P500). This allows them to participate in the growth of the stock market, but not the losses. You original investment/principal is guaranteed by the insurance company. As a trade-off, your guaranteed gains are usually capped at around 5%. However, other features allow FIAs to go even higher when markets do. Every year your gains are locked in and cannot be affected by the future performance of the markets. You can, in fact, double your retirement income base about every ten to twelve years. FIAs could well be considered the best of both worlds, where the stock market is driving the growth of your retirement savings - yet there's no market risk. Ultimately, FIAs are designed to provide life-long income, much like a personal pension. They're ideal for covering the Basic Cost of Living in retirement.

A Few Reasons to Consider a Fixed Indexed Annuity:

Replacing agonizing "Hope for Profits & Fear of Losses" in the stock market – with "Peace of Mind and Financial Security" in FIAs.

No need for costly money management. With FIAs you "Set it & Forget it". Yes, there are surrender charges for early liquidation of FIAs but they're not supposed to be liquidated, nor traded like stocks & bonds. They're supposed to be used for life-long retirement income, not for chasing profits.

When the stock market rallies – you smile. When the stock market crashes – you don't care.

An income stream in retirement can be planned almost to the dollar 10-20 years in advance.

Fixed Indexed Annuities address the 'Pension Envy' syndrome - so common among investors with 401(k)s, who wish they had more financial control and less fear of the markets.

See Sample Chart Below from 2000-2014

In recurring market crashes FIAs do not lose value and clearly outperform the market.

To cover our Basic Cost of Living in retirement - do we play it safe, or do we gamble?

(click on Logo up-top for Home page)